owe state taxes ny

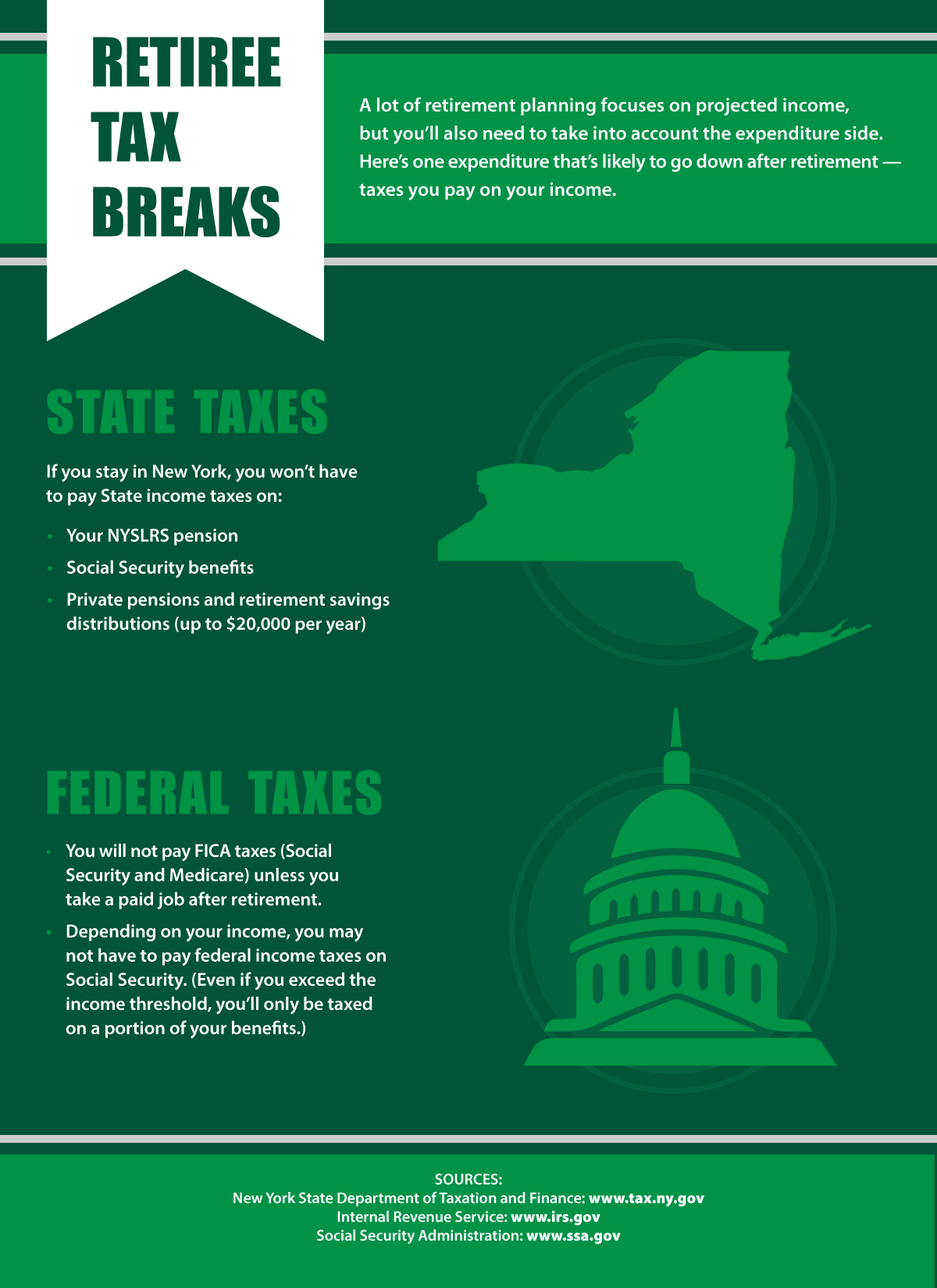

New York State unemployment insurance benefits and any of the special unemployment compensation authorized under the. Any estimated tax payments made.

New York Budget Gap Options For Addressing New York Revenue Shortfall

March 24 2022 924 AM.

. New Jersey has a marginal income tax of 1075 percent for individuals. The Financial Education Program is a series of short modules and videos designed to take you through the benefits available to you and the responsibilities you. New York Post.

What if you owe money. You might be confused if you generally get money back on your state tax but changes to your tax status throughout the year may change how. If you have your.

5 of the tax due for each month or part of a month the return is late up to a maximum of 25 If your return is more than 60 days late your minimum penalty is the lesser. The current amount due may be higher. Tyreek Hill says he spurned Jets for Dolphins over state taxes By.

Once this is released New York State will be able to pursue. You may have lost a property tax deduction or perhaps there is a change in your filing status. Section 171-v of the New York State Tax Law allows NYS to suspend the drivers licenses of individuals who owe 10000 or more in back taxes.

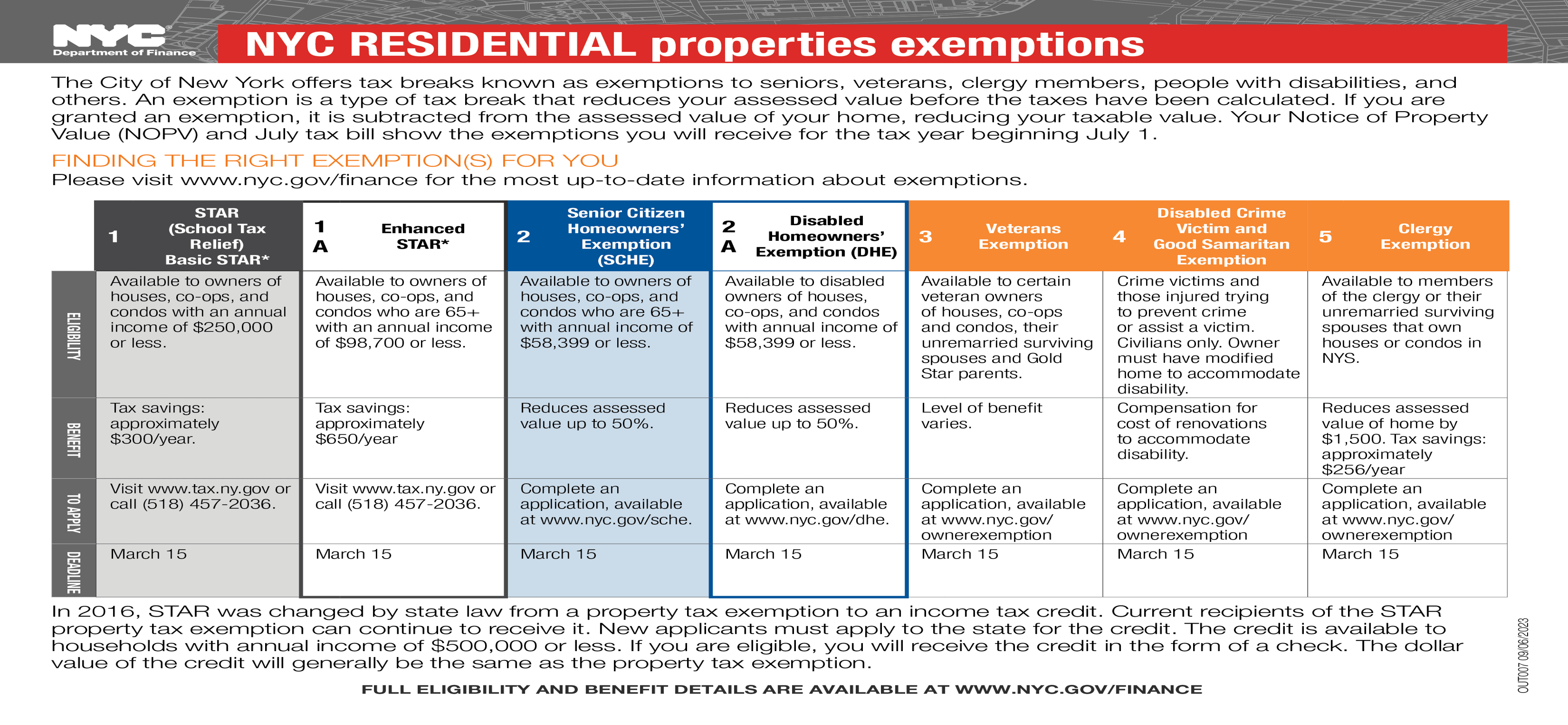

October 6 2022. Payment options The safest and easiest way to pay your bill is with an Electronic Funds Transfer directly from your bank to New York State. New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109.

Pay your bill or notice Pay personal income tax owed with your return Pay income tax through Online Services regardless of how you file your return. If you had good. This amount is cumulative of the assessed.

Enter your Social Security number. If you did not set up a direct payment plan while completing your New York State tax return in TurboTax you can pay your taxes owed by mail or electronically. Select the tax year for the refund status you want to check.

A Few Other Reasons You Owe NYS tax Like it or not tax laws change. And the child and dependent care credit which is a. You can access this page from the Individuals tab in the teal menu at the top of our site.

The New York State Department of Taxation and Finance today reminded taxpayers that the quickest way to check the status of their refund is to use the Check your. Among the credits available are the Earned Income Tax Credit which is worth up to 8991 for a family with three or more children. There are a few ways to apply for a payment plan with New York.

Your tax account balance is the total amount you paid throughout the year toward the tax on the income you made. TOP 250 INDIVIDUALS TOP 250 BUSINESSES The amount of each warrant is the amount due and owed when we filed the warrant. You can pay or.

A tax warrant also known as a tax lien is the equivalent to a money judgment for New York States tax department. New York state income tax rate table for the 2020 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and. How do I apply for an New York State Tax Debt installment agreement over the telephone.

New York state income tax brackets and income tax rates depend on. Online Services and Forms and guidance are also accessible from the same teal. Choose the form you filed from the drop-down menu.

Enter the amount of the. Why do I owe state taxes.

New York Dtf 973 Letter Sample 1

If Times Is Right Trumps Could Face 400m State Tax Bill Crain S New York Business

States With The Highest Lowest Tax Rates

Tax Me If You Can The New Yorker

Form It 201 Resident Income Tax Return The New York State

Additional Information About New York State Income Tax Refunds

New York State Nys Tax H R Block

Taxes After Retirement New York Retirement News

Nyc S High Income Tax Habit Empire Center For Public Policy

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How Do State And Local Corporate Income Taxes Work Tax Policy Center

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

How To File A New York State Tax Return Credit Karma

New York State Income Tax Compared To New Jersey Income Tax

New Yorkers Face Steep State Taxes On Unemployment Benefits

State Taxes On Capital Gains Center On Budget And Policy Priorities